No goggles required… this is not a sales pitch for a virtual reality holiday experience. I simply did not want to disclose too much information from the start. It’ll become clear.

While technology has often been referred to as the key enabler for Digital Trade, the reality is that the available technology itself needs to be enabled via changes implemented at a legal, procedural, operational and … mindset level. On that front, the stars are slowly aligning. With the appetite for Fintech funding slowing down, the runway may have become too short for some, but we are certain that well executed ideas will surely take off.

We can all focus on our own trade domain specialties, whether that is in order management, trade and supply chain finance, logistics, electronic document processing (e.g. e-BL, e-invoice), OCR/AI based document checking and compliance, credit insurance, risk management and distribution … but we are convinced that the best ideas and the real value will be created by efficiently and creatively establishing synergies between closely related existing Trade activities. And there are many, so it is a matter of prioritising the high added value ‘dots’ that are available and connect them. The lack of digital evolution in Trade is mainly a result of the silo mindset, i.e. each domain (as listed above), thinking they are the centre of the universe and coming up with their own silo-based data strategy and standardisation efforts. This is the reason why Trade Finance and e.g. e-Invoicing are still following separate paths, while in fact there is huge overlap and common interest, as explained in a previous article. This is understandable, because they historically started at different times with different objectives. Now it is time though to see the forest for the trees; it is time to understand the positive developments in the different domains and bring them together, but not by building new Digital Islands! That is the journey that is needed to establish true digital evolution. Data Strategy will play a key role here.

Establishing synergies between e-invoicing and Trade is high on our agenda, but not the key topic, well… not for this article at least. We have started with 2 smaller dots, but 2 dots going to the core challenge or risk for buyers and suppliers in International Trade.

Besides ensuring that our solution design caters for cross-platform Interoperability and supports API based exchanges with other Trade participants, our TDS unit’s overriding objective is to always solve a well-defined problem and deliver a working solution. As you can read below, we have had our ‘little light bulb moment’. Now we need to evolve the idea, identify a key partner, that also understands the potential, to provide the Lego brick we are missing, and execute it really well so that it is ready for market adoption.

There are a number of business cases we will keep working on, like our Digital Guarantees solution, which complies with ITFA’s dDOC specifications. This has immediate potential esp. at a domestic level, since they are mostly paper based autonomous undertakings, not facing any external Common Law based obstacles. Key thing is this does not require the set-up of a blockchain platform, with its own rulebook enforcing us to onboard all participants. Applicant, Issuing Bank and Beneficiary are able to securely interact using existing infrastructure, only using a Public DLT Notary, managing document originality, integrity and ownership, without storing any business information on the public ledger. DLT in its most efficient and frictionless way!

That’s not what this article is about though. There’s another business case we believe has tremendous potential as it resolves the key challenges for buyers and suppliers in international trade in full digital fashion, with minimum effort. And yes, it is the BnB solution referred to in the title. Some of you will be aware of the ITFA DNI initiative. One of the key deliverables of this project has been the ePU, i.e. an Electronic Payment Undertaking subject to Contract Law, providing a digital alternative for physical Bills of Exchange (B/E) and Promissory Notes, which are subject to Common Law. It is conceptually very similar to BAFT’s DLPC (Distributed Ledger Payment Commitment), so the digital container defined to store an ePU can also be used to store a DLPC. So, the Bill of Exchange is our first ‘B’.

Then there is all the activity around the second ‘B’, Bills of Lading (BL), from existing and new providers, as well as DSCA’s BL standardisation initiative, following IATA’s example with the eAWB.

The BL, being a Document of Title allows a buyer or his agent to take ownership of goods. The supplier obviously wants to tie in this transfer of ownership to a financial commitment from the buyer… quid pro quo. Letters of Credit and Collections are also designed based on that principle. We are currently extending our already existing front and back end integration framework with Enigio’s trace:original solution to support an ePU business case, i.e. an eCollection as a method to digitally obtain acceptance of a B/E by the Drawee and potentially his bank, in the context of an Exporter, typically an MSME, requiring Finance.

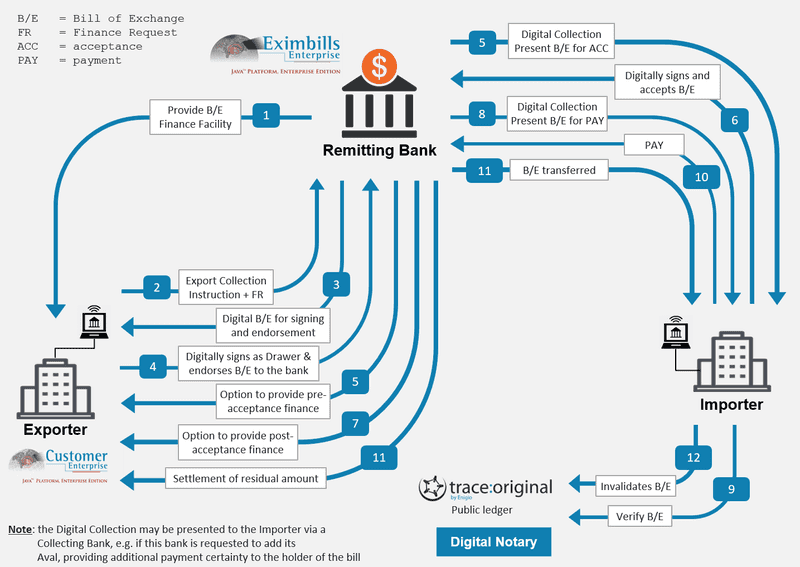

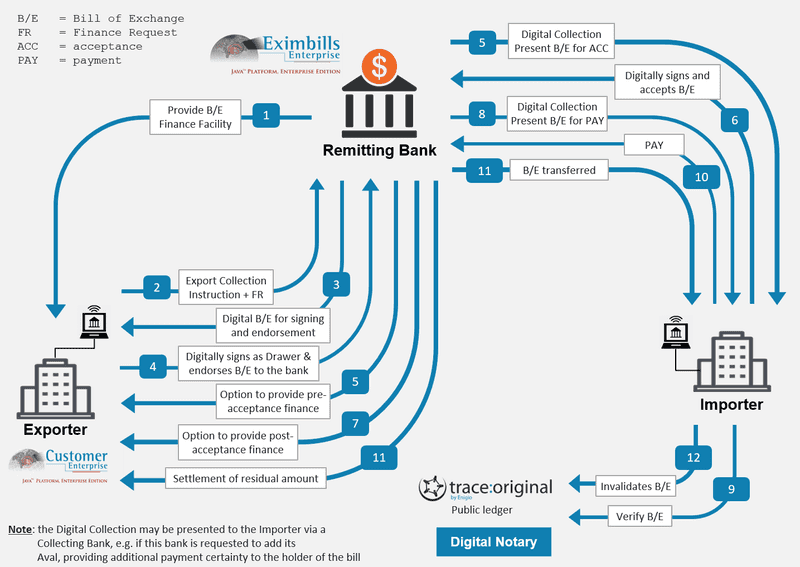

The visual below illustrates the ePU flows, which are all digital. It looks like there are many steps, but they are quite simple, can mostly be executed automatically and some of them also simultaneously.  Our objective is to tie in this digital processing of a B/E with the digital processing of a BL, whereby the ‘quid pro quo’ is based on the Shipper digitally ‘Transferring the rights to the cargo to the Buyer or his agent’ upon digital ‘Acceptance of the B/E by the Drawee/Buyer and optionally his Bank (i.e. Aval), if the Drawer wants payment to be guaranteed by a bank’. So, if we apply this to the ePU business case above, it means that step nr. 6 will trigger a digital instruction on the eBL to change the holder.

Our objective is to tie in this digital processing of a B/E with the digital processing of a BL, whereby the ‘quid pro quo’ is based on the Shipper digitally ‘Transferring the rights to the cargo to the Buyer or his agent’ upon digital ‘Acceptance of the B/E by the Drawee/Buyer and optionally his Bank (i.e. Aval), if the Drawer wants payment to be guaranteed by a bank’. So, if we apply this to the ePU business case above, it means that step nr. 6 will trigger a digital instruction on the eBL to change the holder.

The fact that this can be done in real-time allows us to avoid the situation that the goods arrive before the BL, often leading to a request for a Shipping Guarantee by the Buyer. Traditionally the transfer of ownership/title is handled by physical transfer of a paper BL, which may or may not require endorsement depending on the circumstances. And, as we all know, there are limitations to how fast a paper BL can be physically transferred. A B/E has the same physical challenges around acceptance and endorsement.

It is clear that we have 2 very powerful negotiable and transferable Trade documents, one that allows control of ownership of goods and the other one that can be used to trigger finance or payment. A ‘digital’ match made in heaven, if we combine them in one transaction. I will leave the secondary market potential of the digital B/E out of the scope of this document, but considering the fact that Digital Transfer of Ownership is a key feature of the solution, this is also the perfect instrument for a Digital Secondary Forfaiting market.

There are many more Digital Trade business cases, but our objective for now is to first deliver the ePU business case as described in the diagram above, and then to conditionally activate the APIs needed to interact with an eBL partner solution to support the ‘eBL Transfer against ePU’ solution. We already have all the building blocks and design in place, it is now a matter of connecting the dots to provide a working solution. While we are developing this, we are ready and keen to start conversations with interested parties to discuss and prepare for challenges in the area of regulations, compliance, operational procedures, business and commercial model etc.

To be continued!