If you are just interested in the solution details, click here. But since I put so much effort in setting up the background, you might as well continue reading.

The Pitch

Statistical evidence shows that SWIFT volumes for MT4xx and MT7xx Trade messages have been declining for quite a number of years now, but does that mean that documentary Trade is in decline? That depends on the definition of documentary Trade. All Trade transactions involve documents, so if SWIFT volumes are going down, this has more to do with the methods used to process and settle those type of trade transactions.

The shape of documentary trade is undergoing and will continue to undergo major change. The time and resources spent on transporting paper documents around our planet, evidencing the authenticity and integrity of what is displayed on paper is better spent by implementing a digital original document solution which can be used to securely verify the above aspects, including ownership, by whomever is involved in its lifecycle and implementing legal change to support the shift from tangible to intangible assets. I intentionally still call it documents not records. From a transformational perspective, it would be a huge mistake to immediately try and achieve a shift from physical business documents to records. There are millions of companies with thousands of different systems processing trade documents. To avoid huge resistance from the market, the digital documents or containers storing the business information need to be able to flow through that existing infrastructure to provide operational continuity to the global trade ecosystem. But we do need a public and fully automated technical verification mechanism, and this one can be based on a record. Currently, DLT is best positioned to perform data integrity, originality and ownership checks. That allows every participant to a document flow, regardless what system they use, to make a simple API call to a DLT based Digital Notary only doing automated checks on the topics listed above, without providing access to any business contents of the document. This is in line with ITFA’s dDOC specifications, as well as UNCITRAL MLETR. Decoupling of a document’s business aspects from its technical and security properties opens the gates for interoperability and allows bridges to be built between the different trade platforms, safeguarding digital inclusion.

There is of course a legal dimension, which is crucial in the context of cross-border trade. Legal harmonisation is required to provide trust to all parties involved in a document flow. That is why eBL platforms each have their own rulebook at this point in time, which is also the reason why there is an increasing number of platforms with still a fraction of total B/L volumes being processed digitally. But it can be expected that, following eBL data and process standardisation, that it will become easier to also standardise the rulebook, whereby existing platforms can remain competitive on functionality and commercial aspects while enabling interoperability, avoiding the current ‘switch to paper’ when the next party in the ownership chain has not been onboarded to the same platform as carrier and shipper. We believe that platform protectionist behaviour will not pay off in the medium to long term; those collaborating and providing interoperability will pick the fruits as the efficiencies of such collaboration can be proven.

It is based on those strategic criteria that we are going full steam ahead on showing the results of our collaborative efforts in connecting some of the key dots in the Trade ecosystem. We are pleased to announce that our ‘digital collection combined with receivables financing’ development has been finalised, one month ahead of schedule.

Everyone knows that globally documentary collections are in decline. In fact, no surprise with banks acting as mailboxes between buyer and supplier, having to use courier services between them, and the collecting or presenting bank having to make an appointment with the buyer to ask him to physically sign a Bill of Exchange and take possession of the documents. Some banks have ‘documents in trust’ procedures in place with specific customers to speed up the process, but all in all the amount of time and resources to enable a buyer to conditionally take possession of the supplier’s documents, not to mention the risks of loss, theft and abuse, as well as potential demurrage charges for cargo already arrived at its destination, is a bit ridiculous, and I will not again go into the additional consequences of the pandemic.

The Solution

So, we asked ourselves a very simple question about how to overcome the key challenges for a buyer and a supplier in a Trade transaction. The Buyer wants to be sure he can take control of what he ordered in the fastest and most secure way possible, while the Supplier wants to get a solid financial commitment before the Buyer can take ownership of the goods. Both parties obviously want this done in the most cost-effective way, which implies human intervention should be kept minimal. A Letter of Credit ticks some of the boxes, but not the cost efficiency and speed requirement.

We decided to focus on this exchange of commitments between buyer and supplier and we ended up with this:

That is the summary of today’s process, a documentary collection with a Bill of Lading as the freight shipping document. The advantage of this document is that, based on certain conditions, it can be used as a Document of Title to the goods. This provides control from the supplier or the supplier bank side on the release of goods. It is the perfect instrument to use in conjunction with a Bill of Exchange or Promissory Note which can be used to get a financial commitment from the Buyer (or his bank if an avalised Bill of Exchange is required), and such documents are perfect tools for financing and potential secondary market (e.g., Forfaiting) activities.

To enable this digital handshake between buyer and supplier based on a ‘Transfer of Ownership of a Bill of Lading’ against an ‘Acceptance of a Bill of Exchange’, we have created an end-to-end collaborative digital collection workflow, based on full API integration between our Trade and SCF Back Office Eximbills Enterprise, our corporate portal Customer Enterprise and an eBL platform as well as a solution provided by one of our ITFA Fintech partners, through which digital original documents such as a Digital Bill of Exchange and Promissory Note (= ePU) can be created and transfer of ownership of those documents can be managed using a public DLT based digital notary.

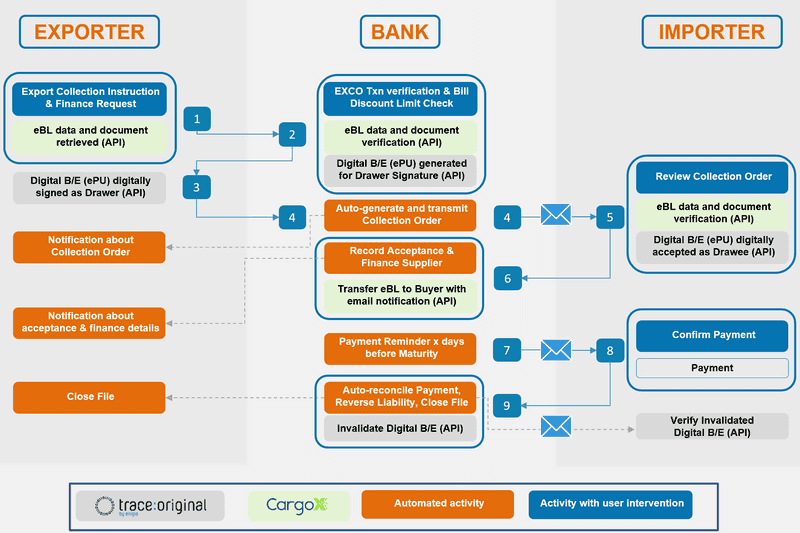

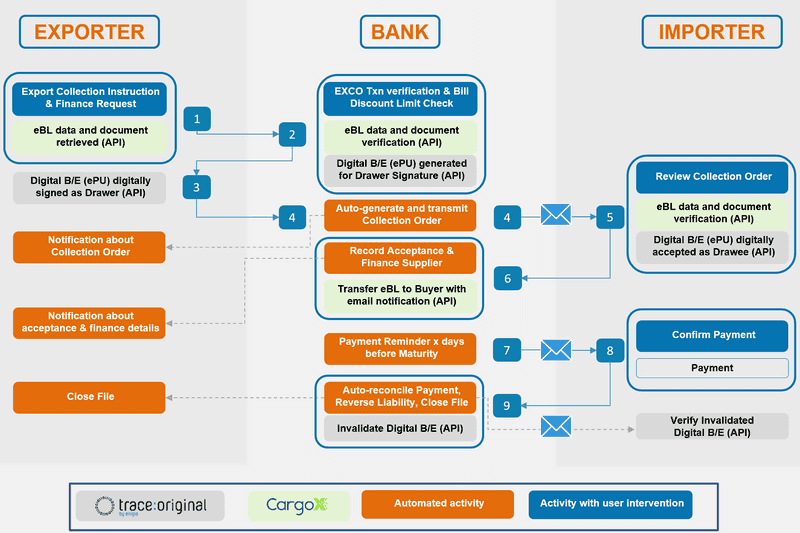

In the diagram below, we have listed all key processes in the digital collection workflow. As you can see, most steps have been automated, including buyer and supplier communication, limit takedown, transmission of the collection order, release of goods and financing of the supplier (optionally set to auto-finance) upon buyer acceptance as well as reconciliation of the payment by the buyer, and subsequent reversal of limits and invalidation of the Bill of Exchange.

The key benefits of this solution are:

- We have used the same infrastructure as the one we use for paper-based collections. So, the solution is future proof, irrespective of the speed of adoption of digital documents and related processes involved. For the end user, the data used to process the transaction, the user interface and the workflows and transaction audit trails are identical, except for some steps which require digital signatures instead of ‘wet ink’ signatures.

- Apart from the back-office solution, which is acting as a Trade Control Tower for the entity acting as intermediary (in this case remitting bank) and financier, the operating model allows us to replace our portal with other single or multi-bank portal solutions or platforms in the market, based on corporate preference and/or bank strategy.

- We can integrate the same solution with other eBL platforms as well as other solutions supporting the creation and management of digital bills of exchange and promissory notes. On this case, we have worked with Enigio and CargoX, with whom the integration was extremely straightforward and who shared a similar vision on collaboration and need for interoperability.

- We can implement this digital handshake within different business contexts, even using different documents, as most Trade and Supply Chain Finance is based on document related triggers anyway.

- There is massive integration potential with other digital initiatives, such as e-invoicing (especially in the case of term invoices)

We are keen to work with more partners, who share the same vision and drive to optimise Trade.

I will end my plea for collaboration with one more analogy. If I fly long-distance, I try to avoid having to check in luggage, pick it up in another airport, check out and in again, each time having to show my passport. There is the wonderful invention of ‘codeshare’, and there could not have been a better word to describe analogies between transport and technology. If all goes well, your baggage (read ‘data’) is handled from the city of origin to the final destination and you only perform one check in for all segments of the trip. That collaboration does not just exist between airlines, but also between airlines and other modes of transport, such as the railway network. The lessons for digital trade are that, for the benefit of the end user, we need to focus on what we are specialised in but ‘codeshare’ our services seamlessly, taking the customer from the starting point as close as possible to his final destination. Another lesson is that we have to move to portable digital identity across different partner solutions, not forcing users to log in to different platforms with different rules. Just like with ‘codeshare’, which requires partners to agree on Baggage Policy, technology partners need to agree on data and security policies.

The future of digital trade will be determined by the level of collaboration that will be achieved. We are proud and also excited to share what we have achieved with our TDS team and our partners.

So, if you are interested to see the result of our Digital Collection development and discuss how this could benefit your Trade operation, please do not hesitate to contact us.