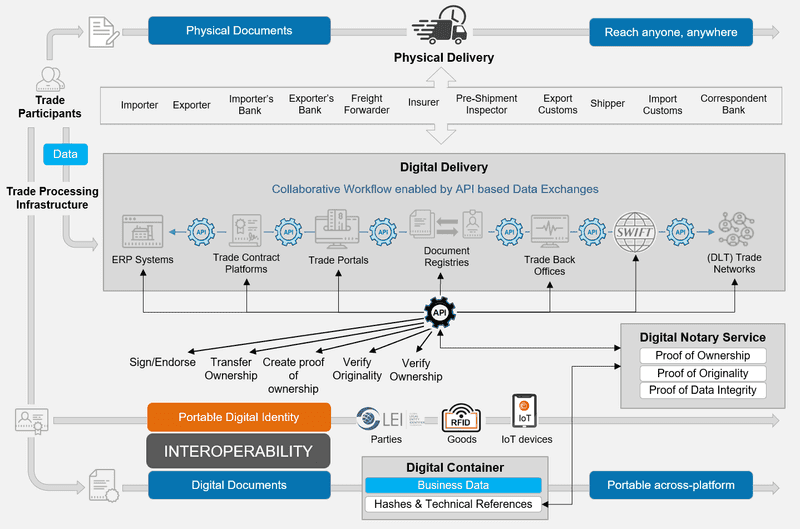

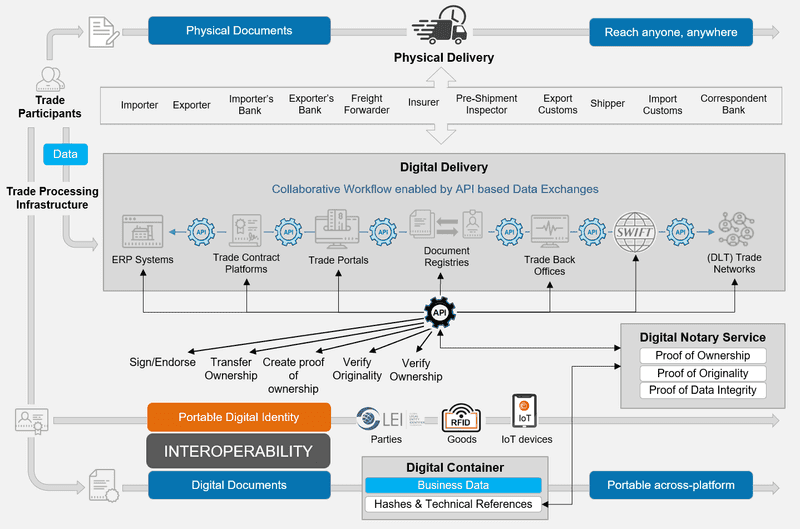

Busy diagram, I know… but it is actually not that complicated. It illustrates at a high level our vision and plan for increased interoperability between the different actors in the Trade ecosystem, with a focus on:

Busy diagram, I know… but it is actually not that complicated. It illustrates at a high level our vision and plan for increased interoperability between the different actors in the Trade ecosystem, with a focus on:

- Documents (dark blue)

- Data (light blue)

- Digital Identity (orange)

These are the key enablers of an end-to-end collaborative Trade workflow, increasing efficiency for all participants in the process.

At the top (in dark blue), you can see how the bulk of documents in Trade transactions are being exchanged between participants today… using physical couriers to move paper across the globe to support and enable the release of cash and goods. We have already taken the first steps towards commercial space travel, but we still need to use vans and planes to send paper around the world to support our trade operations.

It is clear that the use of paper to establish contracts and exchange trade information over the centuries has become so embedded into our business environment and legal framework, that it is not easy to shift to a digital process, especially when there are so many participants involved in a cross-border documentary flow. The most natural path or lowest friction approach for transformation is to mimic the physical flow of documents, but replace physically delivery of printed versions with digital delivery. You could compare it to a sender of a document printing it remotely at the recipient’s address.

The majority of trade document related laws were written when the word ‘digital’ or ‘intangible asset’, such as a digital document, did not exist and as such can also not be possessed, at least based on current UK Common Law. A clear anachronism but a challenge nonetheless, which either requires a Common Law amendment or a Contract Law based workaround. The positive thing is that active lobbying is under way in many countries, and governments are starting to realise that adoption of digital channels is essential to safeguard business continuity and improve economic resilience.

##Digital Documents – secure delivery in real-time wherever you are##

We already mentioned the use of couriers to deliver physical documents worldwide to anyone, anywhere. There is no reason why digital documents should not have the same reach; they should be portable and digitally deliverable across all the trade processing systems and networks (dark blue at the bottom). There are people and companies behind those systems, that need those documents to run their business. Interoperability is essential for any solution aiming to provide support for digital document exchanges.

In order to speed up adoption of digital documents, we need to ensure we can collaborate and use existing infrastructure to exchange digital documents and at the same time have a technical solution that allows this infrastructure to perform all security related verifications in real-time. Therefore, the digital document needs to contain, besides the business data, unique technical references that evidence originality, integrity and ownership. This technical data can be maintained on a public ledger, so that a public notary service can be used at any time by anyone who has received a digital document to verify those key document properties. As shown on the diagram, the Digital Notary Service validating keys and technical references (no business data!) is accessible via an API to all users of existing trade infrastructure.

Perhaps there are other ways to achieve this low friction approach and interoperability. We are keeping our eyes peeled, our ears to the ground, our nose to the grindstone… to ensure we can apply the most suitable and secure technology to deal with this challenge. But, as mentioned in another article …, a solution is available today.

Collaborate to Innovate

Another key element in the trade document digitalisation context is that we need to enable collaborative processing flows between the different systems involved in the procure to pay process. This allows maximum reuse of data (light blue on the diagram) for subsequent processing, digital document generation, cross-checks against physical and financial activities and reconciliation.

In a workshop recently someone mentioned that digital document technology cannot prevent fraud, e.g. a supplier generating multiple documents for the same purpose and requesting payment or finance multiple times. It is possible to check for duplicates if requests flow through the same channel, but it is indeed difficult to prevent fraud, especially in a cross-border context.

However, if you have APIs in place (light blue on the diagram) between e.g. trade contract platforms and systems processing documents presented under that contract, you create transparency and it becomes easy to perform cross-checks and detect irregularities. Also compliance can be built into the process from the procurement stage, so that parties that get involved at a later stage are fully aware of the underlying transaction and also have insight into how the transaction was originated.

Obviously, if the scam starts when the source trade data is originally being created and both buyer and seller are in on it, and potentially other third parties, then we may require more sophisticated assistance, using e.g. IoT based tracking and monitoring solutions. There is no doubt that API based cross-system collaborative workflows can increase the data visibility required to combat fraud. It can also provide a superior digital user experience that no system can provide in isolation, as you can tap into data and services of complementary solutions. This is why TDS is also looking to work with partners to establish joint business cases that will benefit the Trade community.

Homo Digitalis, your passport please

The 3rd point I mentioned was Digital Identity.

Traceability and transparency are essential for global supply chains and trade. This applies to products and materials, which has led to the introduction of RFIDs, but it is also required for devices (in the IoT world) and the parties involved in the trade transaction. Digital Identity for legal entities will facilitate KYC and onboarding processes and trusted interaction between ‘man and machine’.

Efforts are underway to standardise Digital Identity credentials, i.e. make this portable or interoperable, so that digital documents and data can be securely exchanged between legal entities using different Trade processing systems or platforms, in the same way as TCP/IP can be used to securely exchange data between devices over the Internet. The LEI (Legal Entity Identifier), used already by SWIFT to uniquely identify parties to financial transactions, is an important part of the Digital Identity management solution. While portable Digital Identity would further facilitate the exchange of digital documents and assets, its current absence does not stop the exchange between different systems or platforms. Systems like our Eximbills Enterprise back office, are designed to handle multi-channel exchanges based on profile settings of the parties involved in a Trade transaction.

Paper will be with us for a very long time still, but Homo Digitalis has undoubtedly entered the Trade arena.

We just need to make sure that an uncoordinated non-collaborative battle for digital success will not result in an unwinnable war.

Digital islands may sound like an ideal holiday destination, but they are not the place to conduct global trade business.