No, this is not an article about climate change, nor am I going to compare Global Trade to the Titanic. More than ever, we need some positive, creative and collaborative thinking! An iceberg creates an image of a powerful obstacle and the China Systems TDS team loves obstacles and even more clearing them. Iceberg analogy 1/3, tick! What I really would like to discuss in more detail is the digitalisation of Trade, specifically Trade documents, and what we believe is an immediately feasible approach to creating short to medium term benefits at a large scale. The act of replacing a physical document with a digital version is just ‘the tip of the iceberg’. Iceberg analogy 2/3, tick!

Digital Documents are just the starting point for Digitalisation

Real value will be created by optimising all processes around the digital documents with a clear purpose, vision and benefits for end users and customers in mind. We want to create an integrated digital experience, which is fully transparent to users, regardless whether they are processing via digital channels, paper, SWIFT or others. That is our aim! Before I continue, let me immediately try to avoid a debate on semantics... I will be using the word ‘digital document’ a lot. When I do, it must be understood I am not referring to a scanned or digitised version of a document. I know that a structured version of a document is considered by many to be an ‘electronic’ version, like in e-invoicing or eBL.

So, please do a ‘replace all’ from ‘digital’ to ‘electronic’ if this is disturbing to some. This is almost like the definition of SCF, whereby you will also get different definitions depending on whom you ask. Anyway, I will be touching upon scanned documents, but that is not the topic of this article, it is about digitalisation using machine and yes... also human readable documents.

Digital documents, being the missing link between Trade Origination and Settlement (or Procure to Pay) processes, will transform the Trade Industry and unleash the real power of technology, by enabling a real-time data flow required to take instant business and financial decisions, triggering faster release of cash and finance. Quite a mouthful, and ‘missing link’ is probably not an accurate statement, because many industries are already using digital documents, e.g. e-invoicing. There are a number of quality platforms out there which have automated PO and related invoicing processes using electronic document versions, but for some reason these useful developments have not found their way into traditional trade flows yet.

Traditional Trade in the Digital Era: what’s the situation?

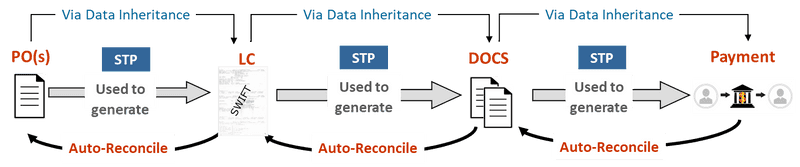

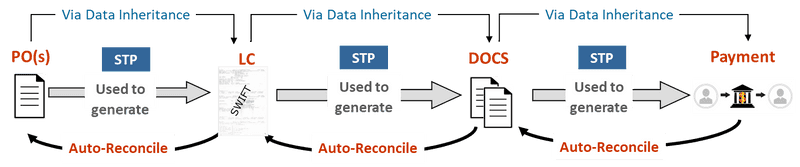

Let’s take a brief look at a primary instrument in international trade, the Letter of Credit. A Goods Description in a SWIFT MT700 LC is an unstructured text block of maximum 800 lines of 65 characters. This is used to stored the data of the Purchase Order(s), and that data is supposed to be used to generate the documents and to serve as a basis for comparison when documents are checked against LC details. The same (non-)structure is used for documentary requirements and additional conditions.

After decades of electronic LC messaging, you would expect that the message data can be used as a source to generate documents, and to track presentations and partial shipments. And yes, OCR and AI can be used to assist analysing and recognizing unstructured data from both the LC and related document presentations. More about that later!

The above diagram shows what technology could be doing and should be doing if the LC message layouts would be upgraded and move away from unstructured blocks of text.

Do you see the missing link or perhaps better the ‘disconnect’ between a buyer’s Purchase Orders and the Invoices and other documents that are supposed to be generated from the Letter of Credit...? Is anyone benefiting from this lack of structure and as a result labour intensive processing …? What is the volume of eUCP based Letters of Credit? No need to answer that one. It is clear that digital document technology has not become mainstream yet, for a number of reasons, as described further down.

Do you see the missing link or perhaps better the ‘disconnect’ between a buyer’s Purchase Orders and the Invoices and other documents that are supposed to be generated from the Letter of Credit...? Is anyone benefiting from this lack of structure and as a result labour intensive processing …? What is the volume of eUCP based Letters of Credit? No need to answer that one. It is clear that digital document technology has not become mainstream yet, for a number of reasons, as described further down. Are things about to change?

2020 is the year that it has become painfully clear what the consequences are of having to rely on physical transmission of documents, as those are the documents that are needed to take business decisions, and release goods or funds. Challenges with getting physical documents to their right destination should never be allowed to put Business Continuity at risk.

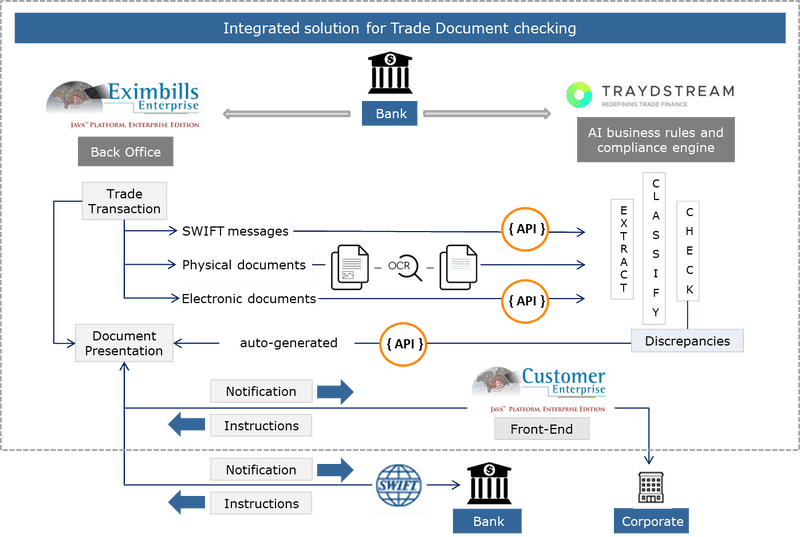

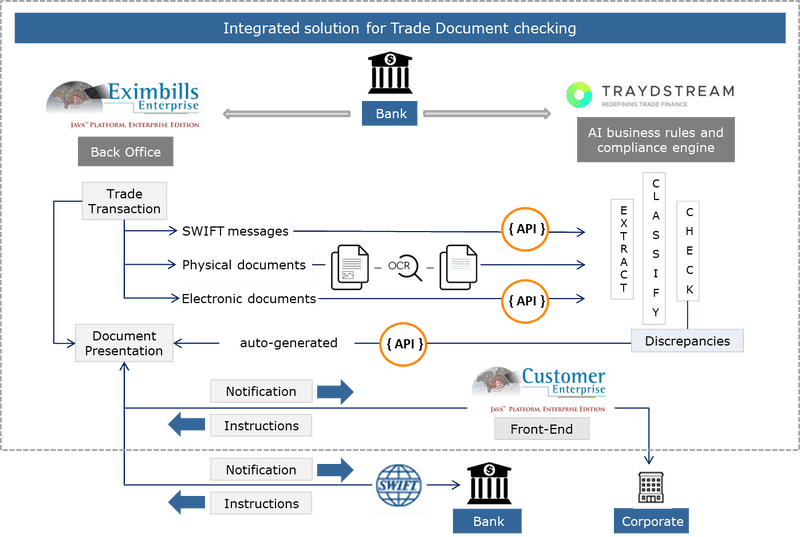

Today, it is perfectly possible to exchange scanned documents electronically to remotely enable staff to perform, optionally OCR/AI assisted, document checks, to maintain business continuity. To meet this challenge, last year we achieved integration between our back office Eximbills Enterprise and Traydstream’s OCR/AI solution. If required, we can apply this integration framework to other similar solutions in the market. Our system feeds their engine with the Trade instrument data, typically LC related, and we pull document presentation and discrepancy data from their system, all API based. For the back-office users, it is an integrated digital experience where they are only triggered to contact the exporter or the other bank when alerted by the OCR/AI engine that the document check is complete. It is the document checker who will use the Traydstream solution to perform the machine assisted document checks, but our back office keeps a full audit trail, i.e. it records all activities related to the documents, whether on our system or the OCR/AI engine. Perfect symbiosis, the ‘mutualism’ kind.

Today, it is perfectly possible to exchange scanned documents electronically to remotely enable staff to perform, optionally OCR/AI assisted, document checks, to maintain business continuity. To meet this challenge, last year we achieved integration between our back office Eximbills Enterprise and Traydstream’s OCR/AI solution. If required, we can apply this integration framework to other similar solutions in the market. Our system feeds their engine with the Trade instrument data, typically LC related, and we pull document presentation and discrepancy data from their system, all API based. For the back-office users, it is an integrated digital experience where they are only triggered to contact the exporter or the other bank when alerted by the OCR/AI engine that the document check is complete. It is the document checker who will use the Traydstream solution to perform the machine assisted document checks, but our back office keeps a full audit trail, i.e. it records all activities related to the documents, whether on our system or the OCR/AI engine. Perfect symbiosis, the ‘mutualism’ kind.

A solution demonstrating the above is available for those interested!

While OCR has its value and can be further improved, it is clear that the value of AI would become much greater if documents would be natively digital.

The availability of technology is definitely not blocking this progress.

Where are the icebergs?

At a high level, there are 2 main challenges.

The first one is legal; i.e. how do you make a digital document and related digital processes legally enforceable? Is it permitted to process the document in a digital form and, if yes, what are the rules, the procedural and security requirements? As a technology vendor and digital services provider, we can only provide assistance on the procedural and security aspects, and the lobbying efforts to change the Law, where required. The second one has to do with the individual and – what is perfectly normal –competitive agendas of the different Trade processing infrastructures, i.e. the incumbent Trade networks, portals and channels, such as SWIFT, and on the other side the new, often DLT based platforms. There is no doubt that DLT enables more efficient exchange of Trade data between participants. I wrote ‘data’, not ‘documents’, as today those 2 things are not yet the same. As I mentioned in another article "The Letter of Credit: A candle in the wind?", there is consensus that real progress will be based on a move from physical documents to digital trade datasets. But this is not achievable in the short term for a number of reasons.

Standards definition is a journey, not a destination

As a result, the approach of organisations involved in standards definition needs to take that reality of ongoing change and coexistence into account. I would expect the ICC DSI to produce a neutral infrastructure-independent approach enabling maximum inclusion and interoperability for the users of Digital Trade Documents and Standards.

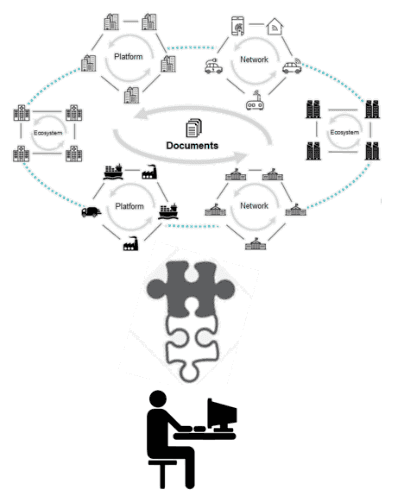

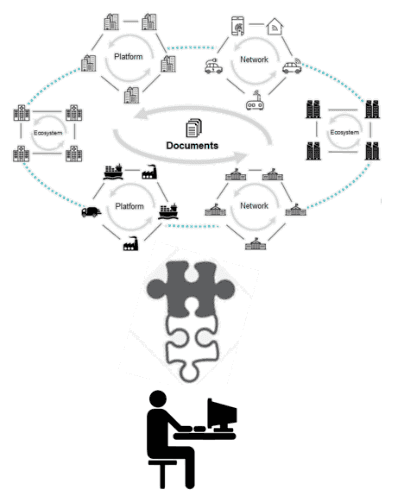

Why does this Interoperability have to be an inherent part of the Digital Standards approach? I am sure middleware vendors can start building connectors and translators between all the platforms. Unnecessary and would only increase cost. To go down that route, there are simply too many participants to a document flow at a global level across all industries, i.e. financial institutions, importers, exporters, logistics infrastructure and services providers, insurance companies, customs, government bodies, inspection agencies etc. If a physical document is replaced with a digital record, you would have to onboard all those parties onto the same platform to manage the lifecycle and the ownership of that document, because you can only apply security and procedures based on the participant’s identity. That is unrealistic.

Why does this Interoperability have to be an inherent part of the Digital Standards approach? I am sure middleware vendors can start building connectors and translators between all the platforms. Unnecessary and would only increase cost. To go down that route, there are simply too many participants to a document flow at a global level across all industries, i.e. financial institutions, importers, exporters, logistics infrastructure and services providers, insurance companies, customs, government bodies, inspection agencies etc. If a physical document is replaced with a digital record, you would have to onboard all those parties onto the same platform to manage the lifecycle and the ownership of that document, because you can only apply security and procedures based on the participant’s identity. That is unrealistic. We must define a solution whereby users can participate in digital documentary flows based on their Digital Identity not based on their access to specific platforms.

That is the exact reason why the existing platforms, which require a governance structure, legal framework, operational and managerial model of the technical infrastructure, are finding it difficult to create critical mass and offer a full solution also covering Trade document flows. They often have to rely on and align with partners for missing functionality in this area, e.g. eBL solution providers. This creates a dependency from a commercial, technology and business strategy point of view in providing end users with an integrated offering.

With the ever-increasing number of DLT Trade platforms, it is crystal clear that the approach to move to digital documents, should not be based on an individual competitive ecosystem approach.

Imagine DHL, FedEx or UPS, today’s leading physical couriers defining a strategy whereby they would only send documents to parties they have onboarded as customers first. Unthinkable.... so why would the digital document world be any different in that respect?

This is why it is a must that digital documents should be portable/exchangeable across all Trade processing infrastructures.

Considering the fact that we live in a multi-standard world, the digital container needs to support open standards and a configurable schema enabling STP based integration. We can use this capability to immediately adopt existing standards and move to production.

Considering the fact that we live in a multi-standard world, the digital container needs to support open standards and a configurable schema enabling STP based integration. We can use this capability to immediately adopt existing standards and move to production. That will allow us to support current and future standards. Digital Documents should be portable, as Digital Identity will, as a logical step, also become portable.

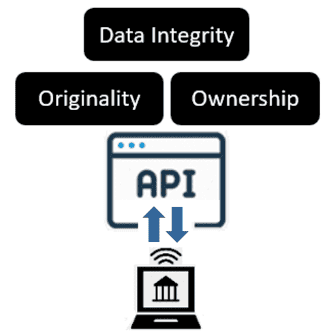

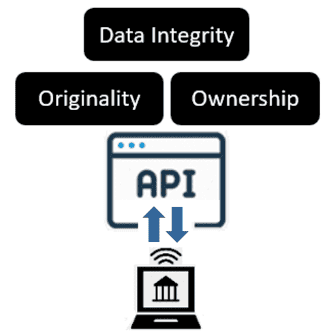

The consequence of not operating in a closed ecosystem is that document security, integrity, originality and ownership (not the business content!) need to be managed via a shared/public digital notary service, that can operate independently, but integrate via an API with Trade platforms.

The consequence of not operating in a closed ecosystem is that document security, integrity, originality and ownership (not the business content!) need to be managed via a shared/public digital notary service, that can operate independently, but integrate via an API with Trade platforms. To meet this requirement, DLT offers the best solution as long as this public ledger does not disclose any business data. That would create legal and security constraints on a public service, not an option. The exchange and processing of business data must be left to the trade networks and applications, which are built to treat business data confidentially.

What is the smoothest path to market adoption and interoperability?

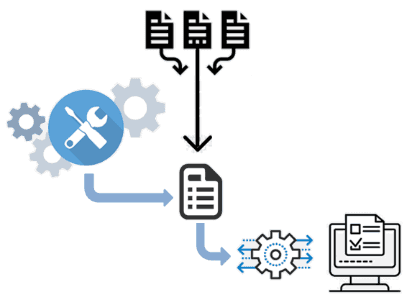

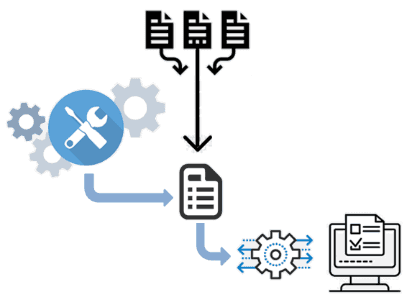

If we summarise the above points, we are in a position to achieve the lowest friction approach for the exchange and authentication of digital Trade documents based on:

- A Digital Container supporting open standards for business content definition

- A public Digital Notary service acting as a document verification engine that can interact via API with existing Trade infrastructure

- Reuse of existing Trade processing infrastructure to act as Digital Courier between participants of a documentary flow

- Not previously mentioned: support for existing Digital Signature software compliant with applicable regulations

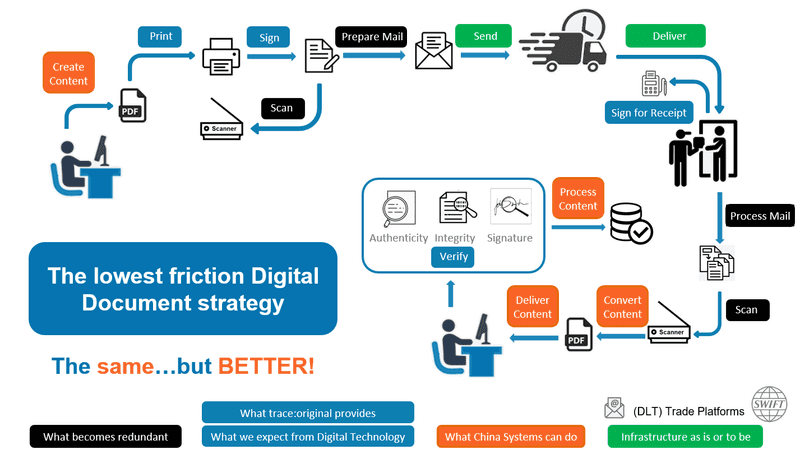

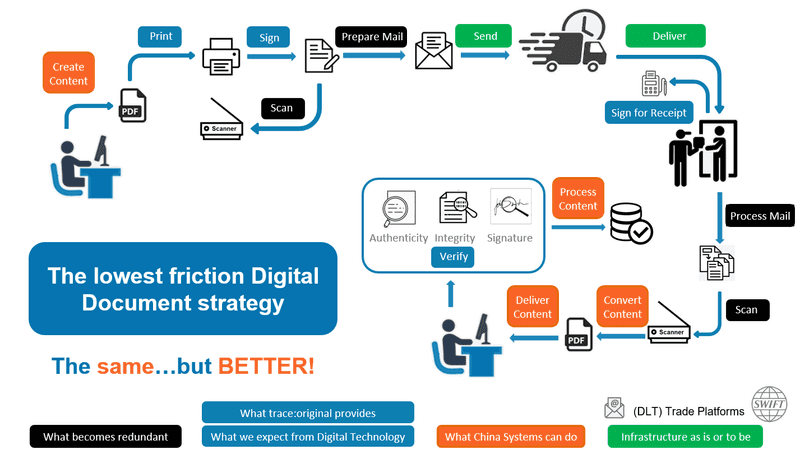

In the picture below, I have tried to visualise what steps take place when one user generates a document and he wants to get that document across to his counterpart, for processing.

So, based on the above diagram, what new elements are introduced in our ‘low friction digital document approach’ compared to today’s paper document flows? Only 2 things: first, the paper is gone and second, proper audit procedures are introduced via the digital notary. The rest stays as is! I think low friction is the right word here.

Just talk…?

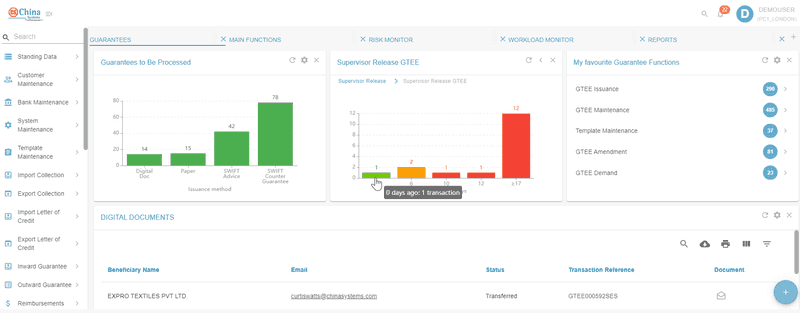

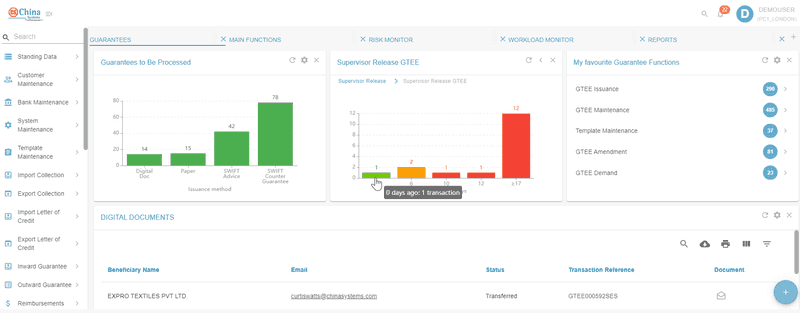

The good news is that, besides talking and writing about what we believe is required for Trade Documents to go digital, we have already achieved this lowest friction approach – the integration of Eximbills Trade platform with Enigio’s trace:original digital document technology.

In our first business case, providing us with the API framework, we have implemented Digital Direct Guarantees, completely replacing the paper version.

The way is now open to apply this to other Trade documents. But it is not enough. We need the community to work together on this, as the business and technology solution are only part of the effort required to achieve adoption at a large scale. It is not the right time to be frozen in our thoughts and actions, like... yes… Iceberg analogy 3/3, tick!

Are you interested in a digital experience with the processing of a Guarantee? The presentation which starts at 17:50 was part of a 2nd Digital Negotiable Instruments (DNI) Initiative Webinar from ITFA. It shows how our Trade solution used for processing (2020 and 2021 compliant!) SWIFT and paper-based Guarantees is reused for Digital Guarantees. You can watch it here.

Are you interested in a digital experience with the processing of a Guarantee? The presentation which starts at 17:50 was part of a 2nd Digital Negotiable Instruments (DNI) Initiative Webinar from ITFA. It shows how our Trade solution used for processing (2020 and 2021 compliant!) SWIFT and paper-based Guarantees is reused for Digital Guarantees. You can watch it here.